Despite the tarriff crisis, the Korean chipmaker is staying the course. The company's head of HBM sales and marketing Kim Ki-tae said: “There has been no change to our sales plans for this year to key customers, which remain in line with the levels set in previously signed contracts."

That includes Nvidia, which just took a $5.5 billion hammering thanks to new US export controls to China. SK Hynix DRAM marketing boss Kim Kyu-hyun said: “It’s unlikely that pull-in demand will rise significantly enough to trigger concerns about inventory buildup.”

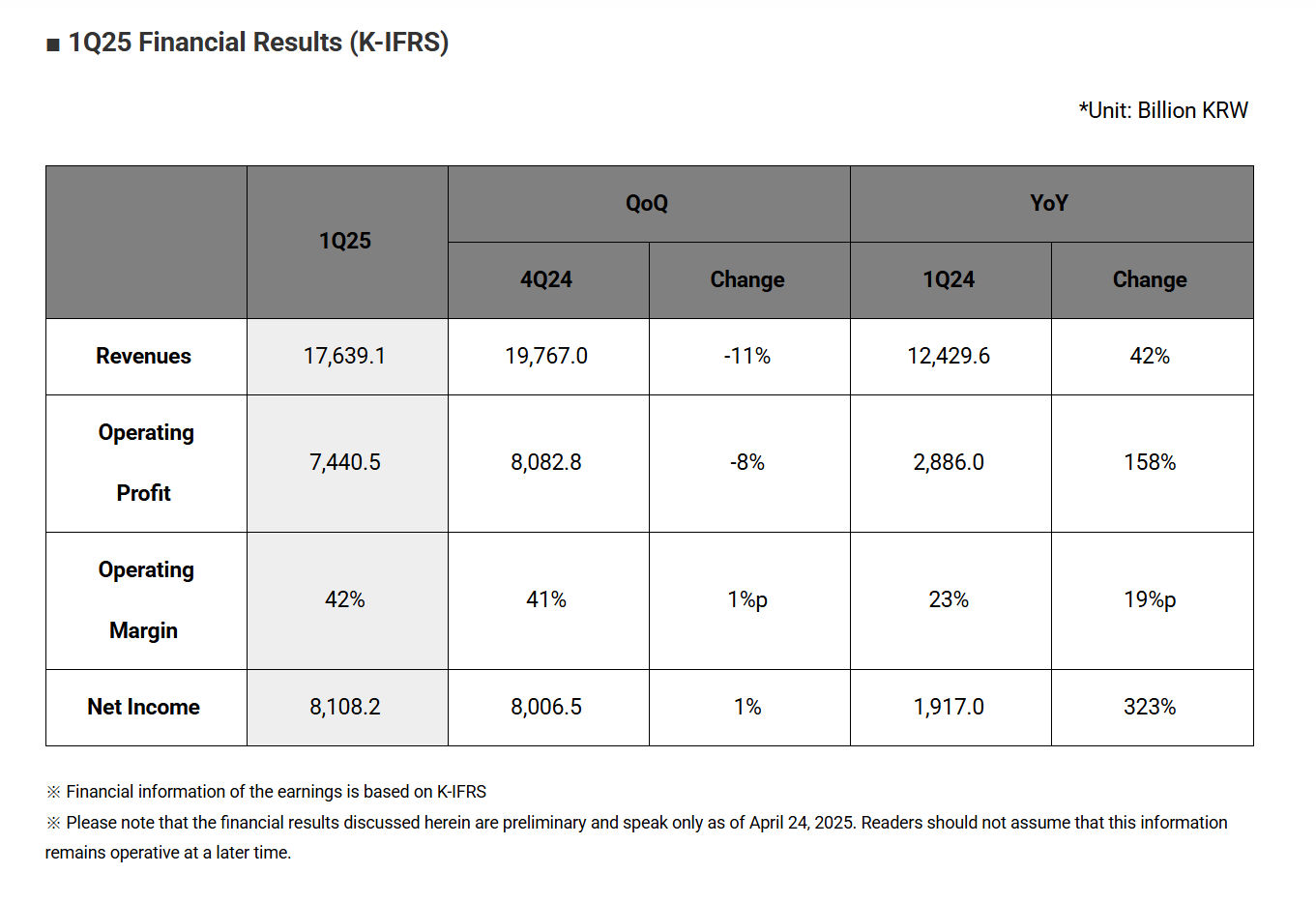

Revenue shot up 42 per cent to 17.6 trillion won (€11.97 billion), with demand for AI gear soaring and customers stuffing warehouses in anticipation of tariff drama. The firm even topped a bullish 6.6 trillion won (€4.49 billion) SmartEstimate from LSEG.

While smartphone and PC chips might see some bumps, the real money’s in AI. SK Hynix reckons Big Tech will keep pumping cash into servers to grab early leads in artificial intelligence. And with phones getting fancier AI features, there’s hope the mobile DRAM market won’t be left holding the bag either.

It helps that SK Hynix isn’t exactly sitting with all its chips in one basket. US buyers make up 60 per cent of revenue, but most products are shipped to places not named America. Apple’s busy cobbling iPhones together in India and China, and Nvidia’s AI boxes are built in Taiwan and Mexico—far from Uncle Sam’s tariff tantrums.

SK Hynix is leading the HBM race while Samsung continues flailing to catch up. It reckons cheaper AI models from China’s DeepSeek will widen access and drive even more demand for its high-density memory chips.

Still, despite the blockbuster numbers, the Cocane Nose Jobs of Wall Street seemed unimpressed. SK Hynix shares dipped 1.2 per cent, trailing the KOSPI’s 0.5 per cent slide.