The outfit’s staggering ascent comes on the back of the AI hype train that’s been thundering down the tracks for the past three years. Nvidia’s graphics processing units, or GPUs, are now the default silicon for anyone wanting to cash in on generative AI’s promise to replace humans and revolutionise everything from spreadsheets to your gran’s bingo app.

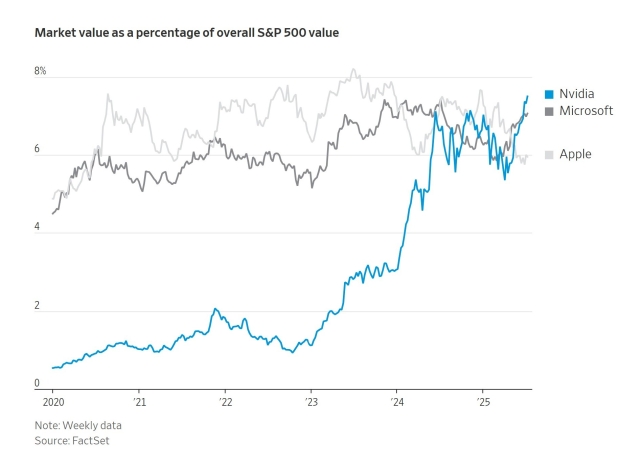

The Santa Clara firm, which once made kit for making games look a bit shinier, is now worth more than the 214 smallest outfits on the S&P 500 combined. Nvidia’s share price closed at $162.88, just shy of the $4 trillion mark, but still comfortably ahead of Job’s Mob’s $3.915 trillion and Microsoft’s $3.708 trillion.

Nvidia boss and leather jacket enthusiast Jensen Huang, who co-founded the company in 1993 to make graphics cards for gamers, now finds himself running the hottest dealer in tech’s latest boom. Over the years, Huang moved Nvidia beyond games into cloud computing, scientific workloads, crypto mining and finally machine learning and AI, thanks to a shift that began in earnest in the early 2010s.

The company started building tools that let developers use its chips for more than just pixels. It began naming chip architectures after dead scientists and sped up its release cycles to one every year. The Hopper architecture, launched in March 2022, was a monster hit, and by 2023 Nvidia had flogged millions of its H100 chips. That got it past $2 trillion.

Then came Blackwell, featuring the B200 GPU with a ridiculous 208 billion transistors squeezed into a silicon slab the size of four Scrabble tiles. Meta, OpenAI and Alphabet couldn’t get enough. Each chip cost tens of thousands of dollars and vanished faster than sweets at a toddler’s birthday.

“Any AI chip Nvidia could make was quickly snapped up,” the company said. No kidding.

But it’s not all been plain sailing. Chinese outfit DeepSeek caused a wobble earlier this year when it built a chatbot using just 2,000 Nvidia H800 processors. That sent Nvidia’s shares into a temporary nosedive, shedding nearly 20 per cent, though it bounced back after big customers hinted they’d splash even more cash.

Washington decided to throw a spanner in the works. The Biden administration restricted H800 sales to China in October 2023, while the Trump camp followed up in April by limiting the H20 chip. That forced Nvidia to take a $5.5 billion write-down.

“With the current export controls, we are effectively out of the China data-centre market, which is now served only by competitors such as Huawei,” an Nvidia spokesman.

Nvidia pulled in $44.1 billion in revenue in its May quarter this year, compared to just $7.2 billion two years ago. That’s with a gross margin north of 70 per cent, which makes the cocaine nose jobs of Wall Street giddy with delight.

Huang is now being talked about in the same breath as Steve Jobs, only with better jackets, slightly less reality distortion and twattage.