Jayqwan Hamilton, Robert Demaio and Jacob Barroso were convicted on all 24 counts, including murder, robbery and conspiracy. They could each spend the rest of their lives in prison.

Julio Ramirez, a 25-year-old social worker, and John Umberger, a 33-year-old consultant, both died of drug overdoses of fentanyl, cocaine and lidocaine administered by the three, prosecutors said.

The Manhattan District Attorney's Office said in a press release, "The defendants lurked outside of nightclubs to exploit intoxicated individuals. They would give them drugs, laced with fentanyl, to incapacitate their victims so they could take the victims' phones and drain their online financial accounts.”

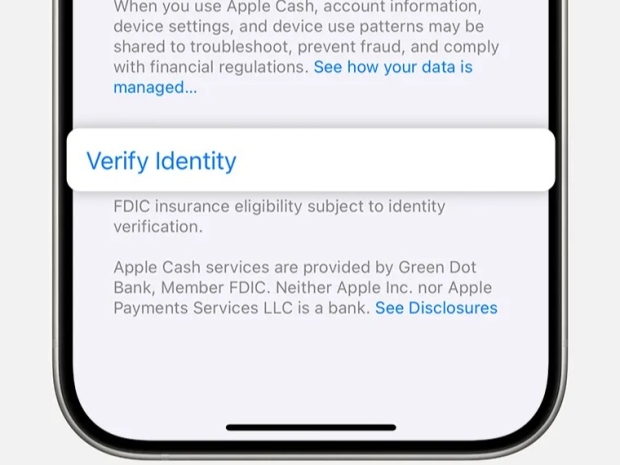

Apparently, they could carry out their plan because the Cash App, Apple Cash, and Apple Pay were wide open.

District Attorney Alvin Bragg called for financial companies to enhance security measures on their phone apps, although the last we checked, Apple Cash and Apple Pay were Jobs’ Mob code.

In 2024, D.A. Bragg called on financial companies to better protect consumers from fraud, including adding a second and separate password for accessing the app on a smartphone as a default security option, imposing lower default limits on the monetary amount of total daily transfers; requiring wait times of up to a day and secondary verification for large financial transactions; better monitoring of accounts for unusual transfer activities; and asking for confirmation when suspicious transactions occur. Curiously he failed to mention any Apple products at the time.

"Thousands or even tens of thousands can be drained from financial accounts in seconds with just a few taps. Without additional protections, customers' financial and physical safety is at risk. I hope these companies accept our request to discuss commonsense solutions to deter scammers and protect New Yorkers' hard-earned money."

EFF's Cooper Quintin has been pointing out since 2018 that mobile phones are unsafe and no one seems to be interested in making them more secure to stop "bank jackings."