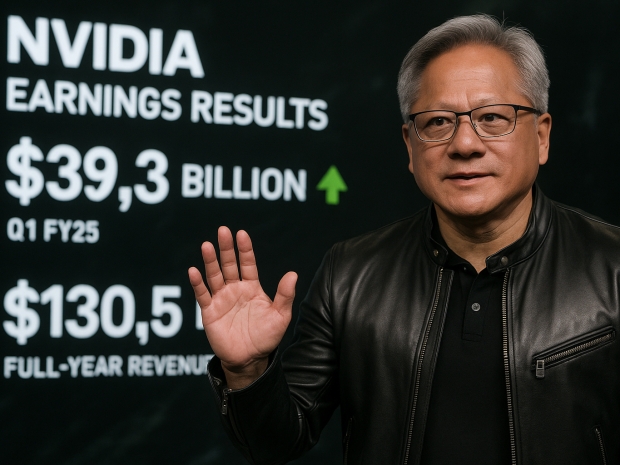

With full-year revenue set to hit $130.5 billion (€120.6 billion), more than double 2024's figure, the company continues to ride the AI wave harder than anyone else in the industry.

The star performer was Nvidia’s Data Centre division. Generating around $21.27 billion (€19.7 billion) in the first quarter, this unit is now the company's most profitable arm, driven by insatiable demand from cloud providers, AI startups and enterprises building foundation models.

CEO Jensen Huang has been vocal about the company’s broader role, stating, “The next industrial revolution has begun. Companies and countries are partnering with Nvidia to shift the trillion-dollar traditional data centers to accelerated computing and build a new type of data center to produce a new commodity: artificial intelligence.”

Nvidia’s Blackwell architecture is the engine powering this revolution. Introduced in 2024 and designed for the most complex AI workloads, Blackwell has enabled record-breaking performance, especially with the launch of the Ultra B300. This version increases memory capacity to 288GB HBM3e and delivers 1.5 times the compute density of its predecessor, B200. Inference times for large models have dropped from over a minute to just ten seconds.

Turnkey systems like the DGX SuperPOD, which bundle Blackwell GPUs with Nvidia’s Base Command software, AI-optimised networking, and storage, are being snapped up by enterprises and research outfits worldwide. Billions have already been spent on these rigs in Q1 alone.

Nvidia has also made headway in gaming and professional visualisation. Its latest GDC announcements featured DLSS 4 and neural rendering, along with RTX Remix and the Half-Life 2 RTX demo. Nvidia ACE (Avatar Cloud Engine) is setting a new standard for lifelike AI-powered game characters.

The company’s AI tools are also being used far beyond datacentres and games. Earth-2, its climate modelling platform, is now employed by The Weather Company and Taiwan’s Central Weather Administration. The platform provides 12.5 times more detailed climate simulations 1,000 times faster and 3,000 times more energy efficiently than traditional systems. The total addressable market for climate risk tools alone is pegged at €130 billion.

Not everything has been smooth sailing. US export restrictions targeting advanced AI chips have cost Nvidia an estimated $5.5 billion in Q1, including lost sales of its H20 chips to Chinese firms. In response, the company is working on a new Blackwell-based chip tailored for the Chinese market.

Analyst Harsh Kumar of Piper Sandler noted, “A revised China chip may not be ready until late July,” which could dent future sales.

Despite these setbacks, analysts remain overwhelmingly positive. Rick Schafer at Oppenheimer said: “Nvidia remains best positioned in AI, in our view, benefiting from full-stack AI hardware/software and unique rack-level approach.”

He also confirmed that production of Nvidia's GB200 rack-scale systems has moved past early issues, with volumes expected to exceed 40,000 units this year.

William Beavington from Jefferies added, “Any quarter-on-quarter growth would be positive,” and suggested that early signs point to improved supply chains and an accelerating ramp-up in Blackwell systems.

Looking ahead, Nvidia expects Q2 revenue to hit $28 billion, plus or minus 2 per cent, with gross margins in the mid-70 per cent range. Even after a market wobble triggered by Chinese AI rival DeepSeek, which unveiled a GPT-4-class model for pocket change, Nvidia remains the world’s second most valuable company and still the backbone of the AI boom.