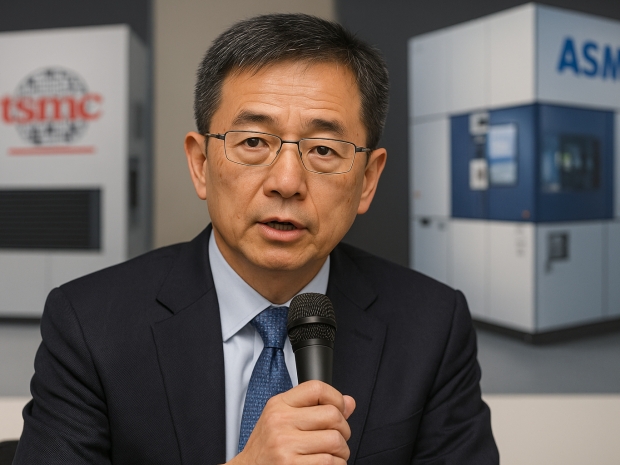

Speaking at a press event, TSMC senior vice president Kevin Zhang [pictured] said the chipmaker still hasn’t found a compelling reason to pay up for ASML’s near €370 million monster.

“A14, the enhancement I talk about, is very substantial without using High-NA. So our technology team continues to find a way to extend the life of current (Low-NA EUV machines) by harvesting the scaling benefit. As long as they continue to find a way, obviously we don't have to use it,” Zhang said.

That cautious approach contrasts with Intel, which plans to use High-NA EUV in its upcoming 14A node. The move is part of Chipzilla’s effort to resuscitate its contract manufacturing business and close the technology gap with TSMC. That said, Intel still promises customers access to older and more battle-tested processes if they prefer.

ASML boss Christophe Fouquet has tried to temper expectations, telling investors he expects chipmakers to keep testing High-NA through 2026 and 2027 before deploying it on top-tier nodes. That timeline is not exactly speedy and highlights just how conservative the industry remains when it comes to betting billions on a shiny new toy.

Zhang has already made his thoughts on the price tag clear. Last year he stated that TSMC would not be using High-NA for its A16 node, citing the cost as a turn-off.

So far, only five High-NA machines have been shipped. The 180-ton monsters sit with three customers: Intel, Samsung, and TSMC. But while TSMC owns one, it seems the plan is still to let it gather a bit of dust while the Low-NA workhorses carry on doing the heavy lifting.