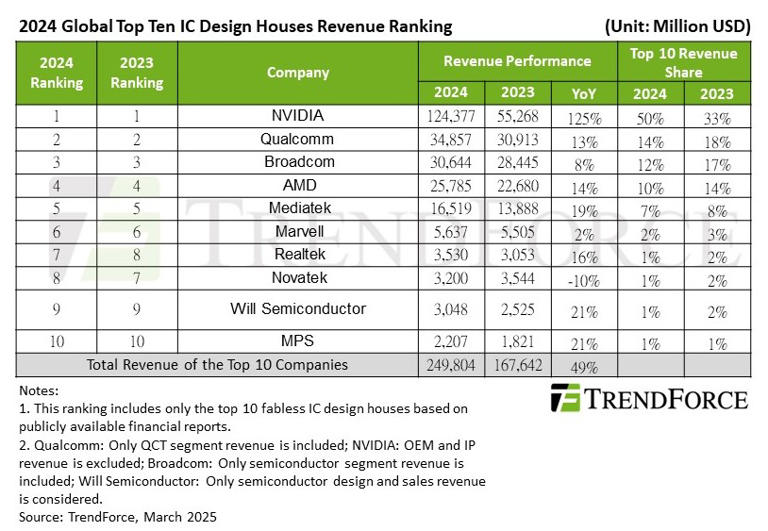

According to a report by TrendForce, Nvidia's revenue skyrocketed to $124.3 billion, up a staggering 125 per cent from 2023. AI GPUs were the golden goose, with Hopper-based H100, H20, and H200 chips making it rain before the Grace-based B200 and GB200 even had a chance to shake up the market. With Blackwell parts being even pricier, 2025 could see Nvidia coffers overflowing once again.

Troubled Chipzilla’s long-time nemesis Qualcomm managed to snag second place with $34.86 billion in revenue, up 13 per cent. Its smartphone and automotive businesses were the lifeline, though the firm is also dipping its toes into data centre CPUs. A legal victory against Arm means its licenses are safe, at least for now, so the company can breathe easy while plotting its next move.

Broadcom, in third place, pocketed $30.64 billion, representing a modest eight per cent increase. AI-related chips accounted for over 30 per cent of its semiconductor revenue, helping to keep things afloat despite a mid-year slump. Next year, the company hopes demand for wireless comms, broadband, and server storage will keep the cash flowing.

AMD took fourth place, growing by 14 per cent to $25.79 billion. While its overall numbers might not be Nvidia-level insane, its server business surged by 94 per cent, securing its spot in the datacentre arms race. Strategic partnerships with Google, and Microsoft should help maintain momentum.

MediaTek rounded out the top five with $16.52 billion, a 19 percent increase driven by mainstream 5G smartphones and AI-related chips. Teaming up with Nvidia on Project Digits should give it an even bigger slice of the AI smartphone pie next year.

Marvell, Realtek, and Novatek followed with mixed results. Marvell grew just two per cent to $5.637 billion, while Realtek saw a healthy 16 per cent boost to $3.53 billion, riding the wave of PC and automotive rebounds. Novatek, however, took a hit, dropping 10 per cent to $3.2 billion.

Will Semiconductor and MPS rounded out the top ten, each growing 21 per cent thanks to high-end CMOS sensors and power management chips worming their way into AI servers and autonomous vehicles.

TrendForce predicts that AI will continue to drive growth in everything from data centres to personal devices. That means more cash, more consolidation, and probably more firms scrambling to ride NVIDIA’s coattails before the AI gravy train slows down.