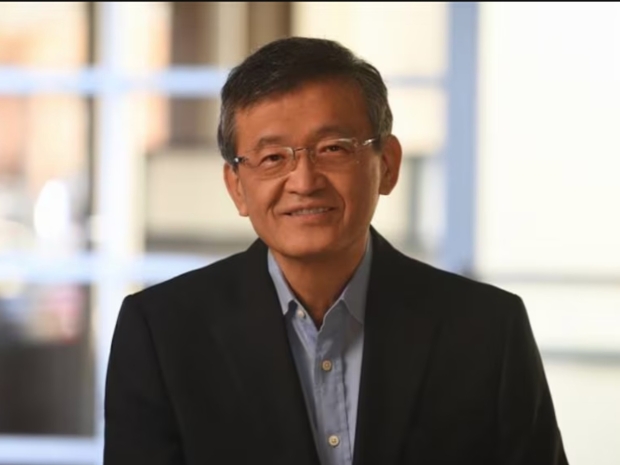

Tan, 65, officially takes the helm next Tuesday, replacing Pat Gelsinger, who was made to return the keys to the CEO's drink's cabinet after failing to revive the once-dominant chipmaker.

Gelsinger’s tenure was marked by a catastrophic 60 per cent stock plunge, the loss of $160 billion in shareholder wealth, mass layoffs of 17,500 workers, and an embarrassing dividend suspension to stop the financial bleeding.

Tan isn't a stranger to Chipzilla, having previously sat on its board before stepping down last August. He spent more than a decade leading Cadence Design Systems, a firm that provides the software needed to design processors.

His return comes at a dire time, as Chipzilla continues to flounder while its competitors lap it on all fronts and rumours that they are teaming up to buy the company.

Interim Executive Chairman Frank Yeary predictably gushed over the appointment, saying, “Lip-Bu is an exceptional leader whose technology industry expertise, deep relationships across the product and foundry ecosystems, and proven track record of creating shareholder value is exactly what Intel needs in its next CEO.”

That remains to be seen, as many have tried—and failed—to stop Chipzilla’s slow-motion collapse.

Gelsinger, who arrived in 2021 with high hopes, ended up presiding over a company in freefall. Recent disasters include delaying the much-hyped Ohio chip factories due to “financial concerns” despite $7.8 billion in promised CHIPS Act funding from the Biden administration.

Once the undisputed king of Silicon Valley, Chipzilla has been thoroughly outpaced by the rise of artificial intelligence, where its once-small rival Nvidia now reigns supreme. Nvidia’s market value has exploded to $2.8 trillion, while Intel has shriveled to a measly $90 billion.

The cocaine nose jobs of Wall Street seem optimistic, as Intel’s stock price spiked more than 10 per cent after the announcement. But Tan faces an uphill battle, and unless he pulls off a miracle, Chipzilla may not be an independent company for much longer.