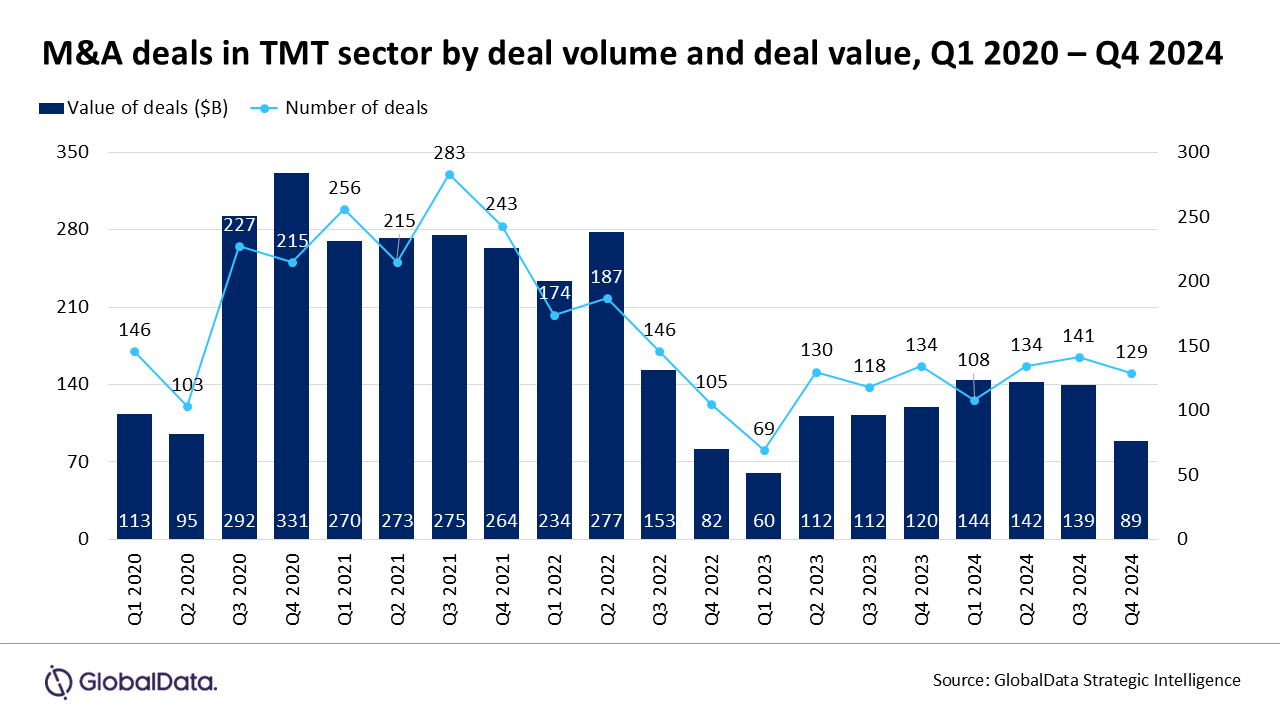

GlobalData’s latest report, Global TMT M&A Deals 2024 – Top Themes and Predictions – Strategic Intelligence, reveals that cloud-related deals totalled $61 billion in 2024, making it the second-largest theme among the top 100 deals and reflecting a remarkable 221 per cent growth from the previous year. Overall, the total value of TMT M&A deals worldwide grew by 27 per cent in 2024 to reach $514 billion, compared to $403 billion in 2023. Deal volume also saw an increase, totalling 512 deals—a 14 per cent rise from the previous year.

GlobalData Strategic Intelligence Analyst Priya Toppo said adopting cloud-based solutions is essential for maintaining a competitive edge, while those slow to adapt risk falling behind.

"To enhance cloud performance, companies have invested in AI-driven IaaS, PaaS, and SaaS solutions, alongside expanding hyperscale cloud infrastructure and edge AI capabilities,” Toppo said.

The most significant cloud deal of the year was Blackstone’s $16 billion acquisition of AirTrunk, which was also the largest transaction in the APAC region (excluding China). Other major deals included IBM’s $6.4 billion acquisition of HashiCorp and the $4.4 billion purchase of Alteryx by Clearlake Capital Group and Insight Partners.

“A significant amount of M&A deal activity was driven by the application software sector in TMT, accounting for $253 billion across 230 deals. This was followed by the telecom services, IT services, music, film & TV, and gaming sectors,” Toppo said.

By examining current market trends, GlobalData’s report also identifies potential future acquisition targets and their thematic rationale. Major industry players such as Microsoft, Google, Amazon, and Oracle have been actively acquiring AI-native cloud firms, cybersecurity providers, and data analytics companies to enhance their cloud ecosystems.

“Although the TMT sector saw growth in M&A activity in 2024, cloud deals played a crucial role. However, the outlook for 2025 remains subdued, with both deal value and volume expected to decline. Nevertheless, easing inflation and lower interest rates may pave the way for a gradual recovery,” Toppo said.