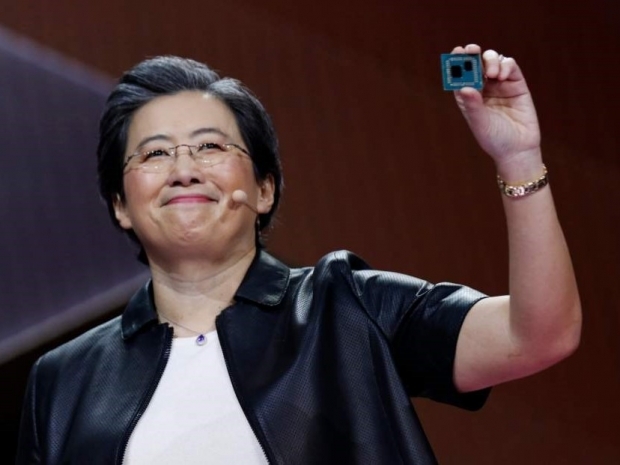

The news comes as boss Lisa Su confirmed the company’s next-generation EPYC Venice CPUs and Instinct MI400 AI accelerators will land in 2026.

The data centre division led the charge with $4.3 billion, up 22 per cent year on year, while the client and gaming business surged 73 per cent to $4 billion. Only the embedded segment dipped, sliding eight per cent to $857 million.

AMD’s gross margin held steady at 52 per cent on a GAAP basis and 54 per cent non-GAAP, which pleased the cocaine nose jobs of Wall Street.

Su confirmed that the 2 nanometre EPYC Venice CPUs, built on TSMC’s shiny new N2 process, are already in the lab and performing “very well.”

She said, “We remain on track to launch our next-generation 2-nanometer Venice processors in 2026. Venice silicon is in the labs and performing very well, delivering substantial gains in performance, efficiency and compute density. Multiple cloud OEM partners have already brought their first Venice platforms online.”

The Venice chips will be the first HPC products made on TSMC’s 2 nm technology, offering major performance gains over the current Zen 5 based Turin parts. AMD’s cloud partners have already fired up early systems, setting the stage for a wide rollout next year.

Su said the company’s Helios rack scale platform pairing Venice CPUs with Instinct MI400 accelerators is building serious momentum. The MI400 series will pack up to 40 petaflops of compute and a hefty 432 GB of HBM4 memory running at 19.6 TB/s, squarely targeting Nvidia’s upcoming Rubin platform.

“Our data centre AI business is entering its next phase of growth. Customer momentum is building rapidly ahead of the launch of our next-gen MI400 Series accelerators and Helios rack scale solutions in 2026," she said.

The MI400 line has already locked in deals with Oracle and the US Department of Energy. Oracle will deploy tens of thousands of MI450 GPUs across its cloud platform starting in 2026, while the DOE has chosen MI430X GPUs and EPYC Venice CPUs to power Discovery, a new supercomputer at Oak Ridge National Laboratory.

On the client side, Ryzen 9000 desktop CPUs continue to carry the load, driving record sales. AMD said Ryzen-powered PCs have seen robust demand across gaming, productivity and content creation, with notebook sales rising sharply as well. Su hinted that a soft refresh of the 3D V-Cache chips will land around CES, with Zen 6-based Ryzen parts expected in the second half of 2026.

Gaming revenue rocketed 181 per cent year on year to $1.3 billion, thanks to booming console orders from Sony and Microsoft and growing traction for Radeon RX 9000 GPUs based on RDNA 4. The firm’s FSR 4 upscaling tech is picking up steam, now supported in more than 85 titles.

AMD will host its 2025 Financial Analyst Day on November 11, where it is expected to brag further about Zen 6, MI400, and the company’s growing dominance in AI and gaming.