The Taiwanese chip titan only expanded into America because the Trump administration leaned hard on it to bolster domestic semiconductor supply.

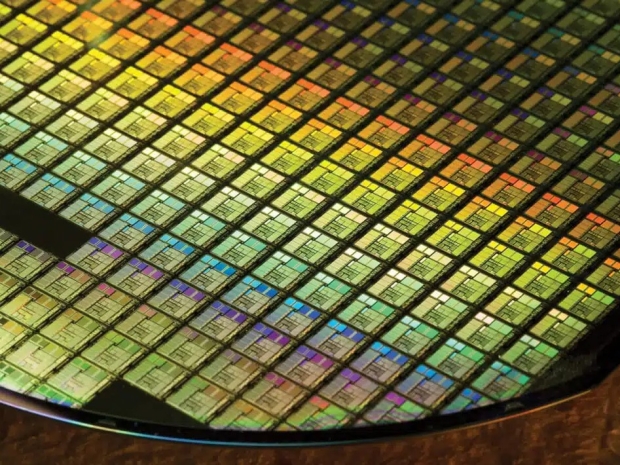

The Arizona facilities are churning out wafers, but the price tag for clients like AMD and Nvidia is five to 20 per cent higher than Taiwan’s production, a fact AMD boss Lisa Su openly admitted during an AI event in Washington, according to Bloomberg.

Before TSMC’s arrival, the US chip supply chain was practically non-existent for bleeding-edge nodes. Apart from Intel, no one else on American soil could deliver the latest tech. Now, TSMC’s Arizona fab has become the fallback option, even if it means paying a premium.

Labour costs are higher, importing specialised equipment isn’t cheap, and the US semiconductor supply chain simply lacks the maturity of Taiwan’s tightly integrated ecosystem. All of this makes the Arizona venture an expensive affair, but clients are still queuing up. Taiwan’s production lines are already maxed out, so the alternative is waiting or paying more for local capacity.

AMD jumped early, being one of the first to place 4nm orders at the Arizona fab, with plans to move its EPYC Venice data centre CPUs to 2nm when the facility catches up.

Demand for AI silicon isn’t slowing either, with Su predicting the total accelerator market could explode to \$500 billion within five years as partners scramble to secure enough chips.

For now, it’s either cough up for the pricier Arizona wafers or risk being left behind while the AI gold rush eats through every bit of available fab capacity.