Microsoft announced the ambitious build in 2023, targeting New Albany, Heath and Hebron with a three-campus setup. Now, it’s all been chucked into the long grass under the banner of a reworked “investment strategy.”

“We will continue to evaluate these sites in line with our investment strategy,” a Vole spokesperson mumbled to The Columbus Dispatch, before thanking Ohio’s suits and Licking County locals for their “support.”

The scrapped project would’ve gobbled $700 million in construction and $300 million on gear, spawning 400 temporary jobs and potentially hundreds of full-time roles. Not anymore. Locals can look forward to… farming.

According to WBNS, New Albany City Council had already handed Microsoft a 15-year, 100 per cent property tax abatement, smoothing the way for what was billed as a critical Azure infrastructure hub. Now the only thing flowing might be soybeans.

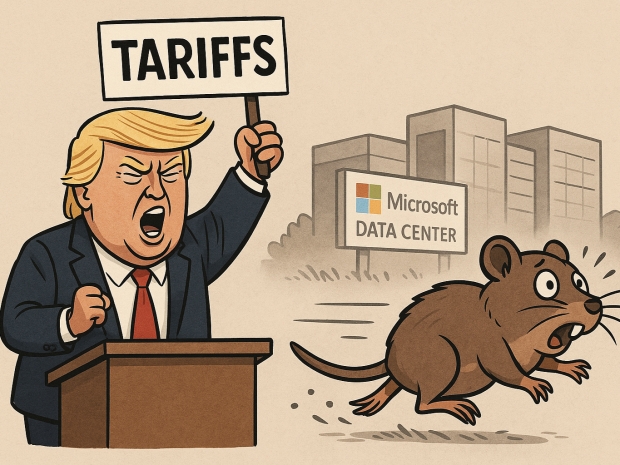

Analysts say Trump’s tit-for-tat tariffs—34 per cent on Chinese tech kit, 32 per cent for Taiwan and 25 per cent on South Korea—are set to kneecap cloud expansion. The baseline 10 per cent sting on all other imports to the US adds salt to the wound.

Everest Group partner Abhishek Singh told Reuters: “Capital expenditure by tech giants will get reshuffled: Expect major players in AI infrastructure and consumer tech to reallocate short-term spending away from expansion and toward procurement hedging or sourcing shifts.”

While semiconductors dodged the tariff hammer—for now—a White House lackey admitted chip-specific levies might follow.

D.A. Davidson analyst Gil Luria said: “There’s no doubt that the equipment that goes into data centers will become significantly more expensive. Microsoft and Amazon, he said, are already “articulating a more balanced, cautious approach” to infrastructure build-outs."

TD Cowen’s analysts claimed Vole has walked away from projects totalling 2 gigawatts of data centre power in the US and Europe in just six months. In February, it cancelled leases totalling “a couple of hundred megawatts” with private operators.