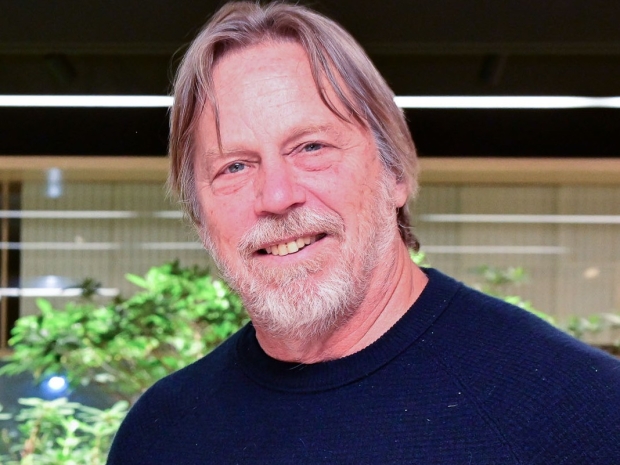

Keller, a former lead silicon engineer at Intel and now CEO of AI chip startup Tenstorrent, took to Twitter to slam reports of a potential Intel split or sale.

“You build value by having a great goal and a team that loves working to the goal,” he wrote.

“Intel built the fastest CPUs on the best process technologies. This is not unlocking shareholder value; it is a fire sale. It makes me sad.”

Rumours have swirled that Broadcom could be eyeing Intel’s product business, while Intel Foundry might enter a joint venture with TSMC, Qualcomm, and other deep-pocketed firms.

But Keller isn’t buying it. He believes a fully revitalised Intel could be worth $1 trillion, warning that breaking it up is "a little careless."

One commenter suggested taking Intel private, firing the board, and rebuilding from the ground up. Keller admitted it would be “hard but doable” but stressed that success comes from a shared vision and a committed team.

Washington is unlikely to back Intel’s fabs falling into foreign hands, but if Intel ditches its manufacturing, it loses a key advantage—complete control over its products. Even if Broadcom takes over Intel’s products division, such a deal would automatically terminate Intel’s cross-licensing agreement with AMD, potentially cutting off access to crucial chipmaking innovations.