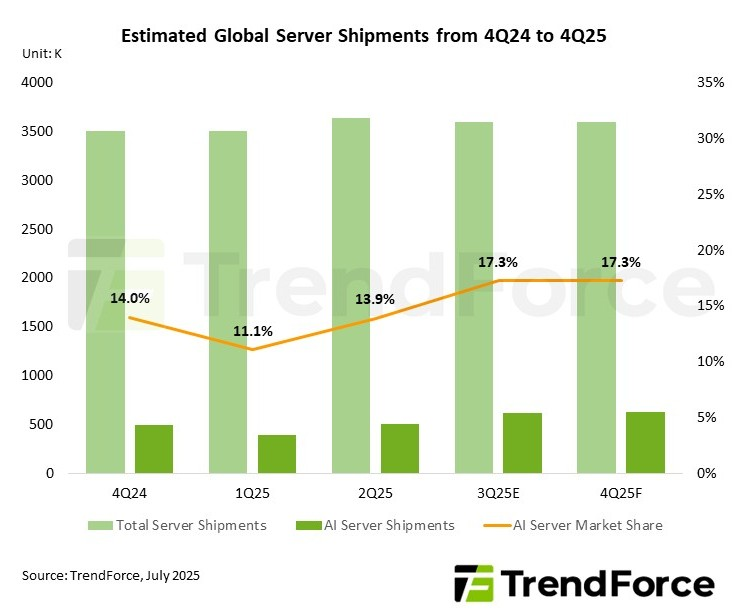

Number crunchers at TrendForce have added up some numbers and divided by their shoe size and reached the conclusion that it is all doom and gloom in the AI server market. It has cut its 2025 global AI server shipment growth estimate from 28 per cent to 24.3 per cent, citing US export controls, supply chain snarls, and general unease over President Donald Trump’s latest tariff chatter. That’s still healthy growth, but the momentum has clearly taken a knock.

Big Tech is ploughing ahead regardless. Microsoft, Meta and Google continue to throw billions into AI infrastructure, snapping up Nvidia’s latest Blackwell Ultra GB300 servers. Microsoft’s in-house chip project has reportedly slipped to 2026 after failing to hit the mark.

Despite supply disruption, Nvidia remains firmly in charge. Its kit continues to dominate the AI server scene, with rivals like AMD gaining traction through rack-scale solutions. Google and Meta are hedging their bets, leaning on their own silicon, especially Google’s Tensor Processing Units, while keeping Nvidia close.

The broader trend is unmistakable. AI infrastructure spending by tech giants is still climbing, and the appetite for faster, denser, more power-hungry compute isn’t going anywhere.

What’s changing is the risk. Supply chain instability and evolving trade policies are injecting uncertainty into forecasts. Even as Vietnamese retailers scramble to build servers using GeForce RTX 5090 GPUs amid hardware shortages, the underlying pressure on logistics and cross-border flows is growing.