The milestone followed better-than-expected fourth quarter results with growth driven by Azure, Copilot, and a herd of generative AI services. Nvidia, which got there first, was still floating at $4.34 trillion, with its shares at $178, while Microsoft shares took a four per cent kick in the ribs to land around $534.

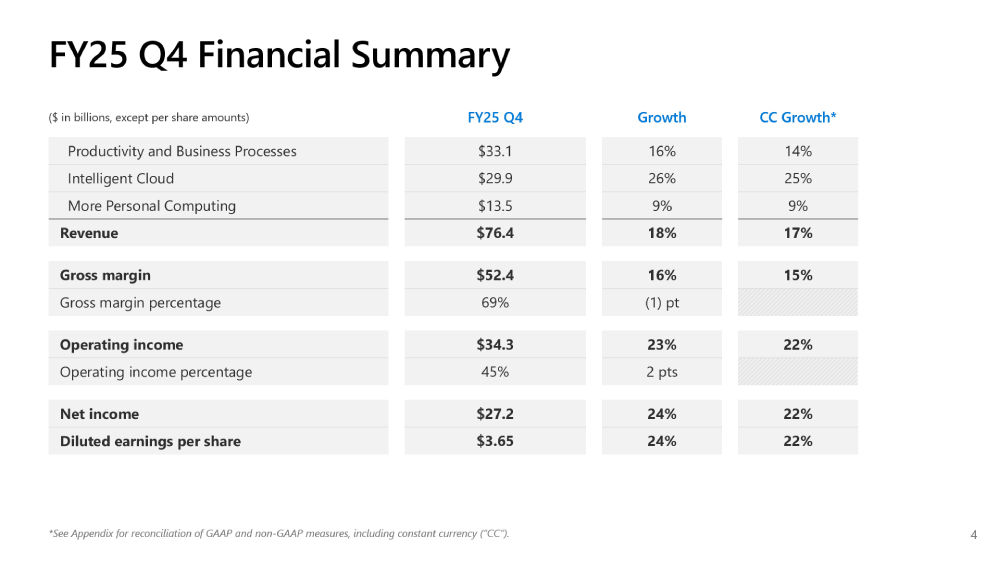

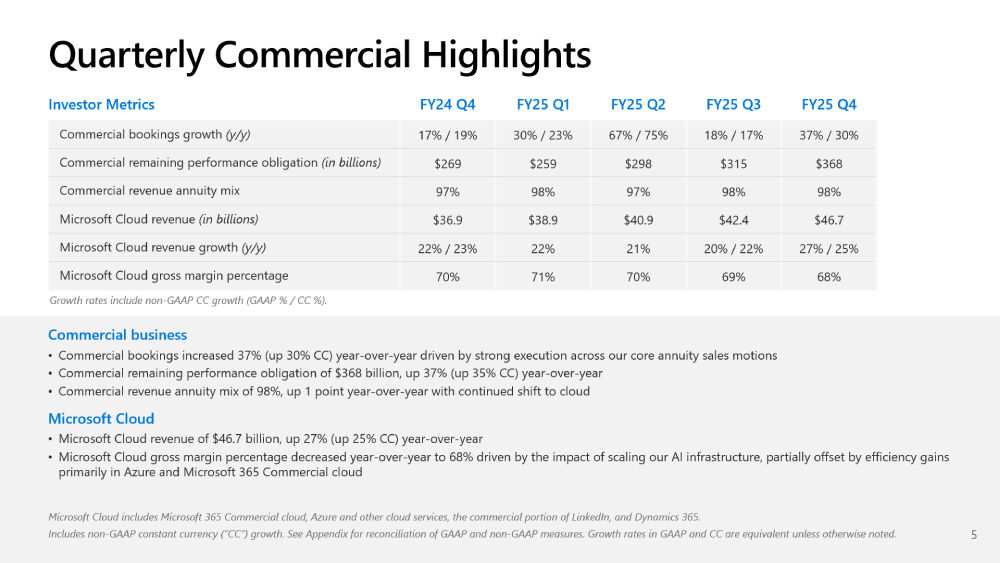

According to a Morgan Stanley scribble, Microsoft’s revenue for the quarter ending 30 June beat Wall Street’s guess by about three per cent. A 21 per cent year-on-year backlog hike suggests growth still has legs, while operating margins went up two per cent. That should help justify the piles of cash Microsoft is setting fire to as it builds out data centres for AI.

Microsoft partner Troinet chief executive Wayne Roye told CRN the goldmine lies in tools that let people build their own AI agents.

“The new real estate out there is people that are creative, creating AI agents and how to use that in a business process to get stuff done,” he said.

Azure clocked 39 per cent growth, topping estimates and up four points from the previous quarter. That brought in an extra $2.3 billion compared to Q3.

Vole warned of a gentle slowdown, forecasting 37 per cent growth in the next quarter, but still decent for a cloud that everyone said had already peaked.

Bernstein analysts reckon AI is pushing companies to ditch on-prem data because dragging that sludge into inference pipelines is slow, clunky, and expensive.

They wrote: “The results are suboptimal and metadata is not easily available. Moving on-premises apps and databases to the Cloud facilitates and streamlines leveraging and building AI and this could be one of the reasons for the strong growth.”

Beyond Azure, Microsoft said Copilot now has 100 million monthly active users and that 800 million punters are using AI features in tools like Teams. Most of that is not GenAI, just dull things like auto-summarising meetings no one wanted to attend anyway.

Melius Research says the spend on AI compute should also spill over into other kit like GPUs, CPUs, and networking gear. That’s good news for Nvidia, AMD, and Arista Networks, plus their resellers sniffing out margin.

Microsoft claims its software updates have improved token processing efficiency by 90 per cent on the same model and GPU as last year. It has bragged about tenfold improvements in model layer efficiency and threefold gains on the GPU layer.

Chairman and chief executive Satya Nadella made the usual noise about migrations, highlighting SAP, VMware, and Microsoft server workloads. Microsoft Fabric revenue jumped 55 per cent year on year, and Dynamics 365 hit 21 per cent growth, up from 16 per cent the previous quarter.

Microsoft 365 growth slowed a notch, with seat count up just six per cent, down from seven. Even so, M365 Commercial Cloud revenue grew 16 per cent year on year, thanks to a push on higher-priced E5 licences.

The security biz now has 1.5 million customers, according to execs, but Microsoft CFO Amy Hood kept schtum on whether the channel partner programme is getting any real attention.

Bank of America said in a report that if Microsoft sorts out its channel investments, it recently announced cash for partners in AI and security, there might be some actual upside for those flogging its wares. For now, the channel gets to cheer from the sidelines while Redmond rides the AI gravy train.